In recent years, there has been a growing trend where venture capital investors are shifting their attention to emerging managers in search of sustained alpha.

These emerging managers typically have limited experience however they have a unique edge in particular sectors and/or a unique access to specific geographies/areas.

“SVB Capital’s emerging manager practice in 2022 tracked 1500+ EMs and it is up 2.25x since 2019”

(2022 Preqin Global Venture Capital Report)

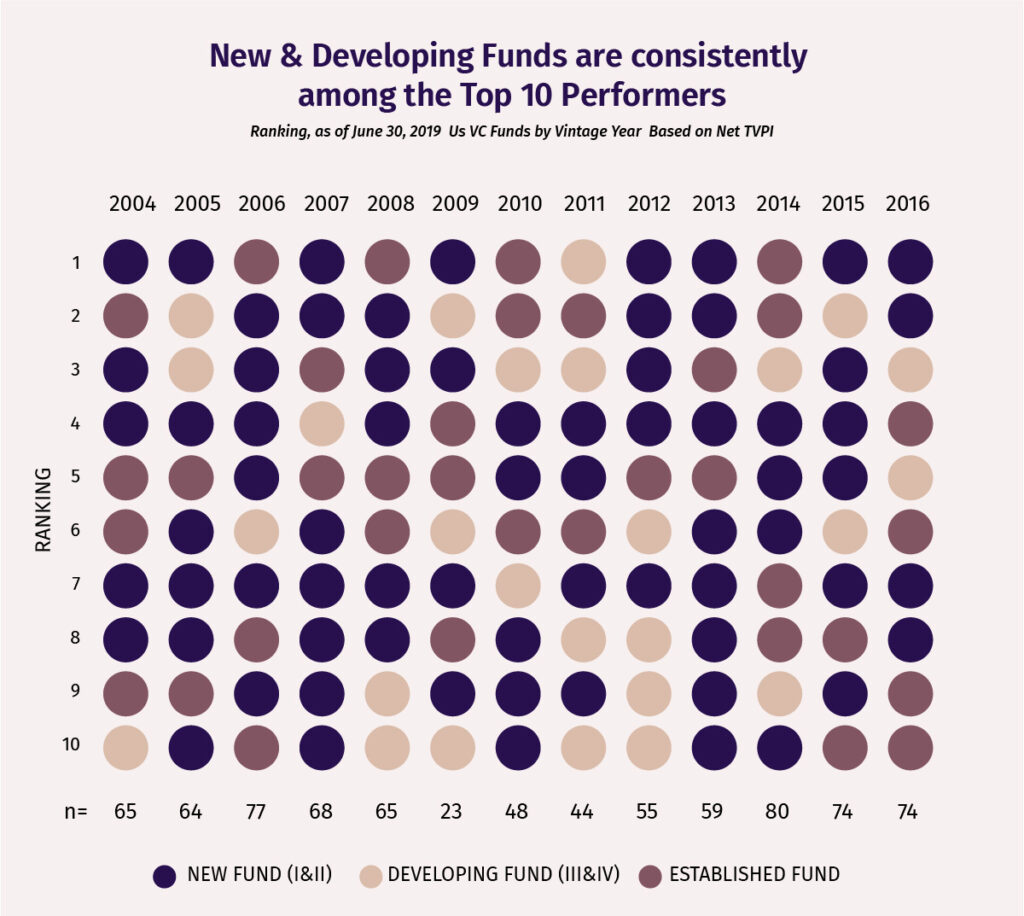

Cambridge Associates published their research on Global Venture Capital Periodic Rates of Return and they found that “new and developing fund managers consistently rank as some of the best performers”.

Emerging managers have relatively new funds (typically 3 funds or less) with smaller capital pools (typically <$150M) than their more established counterparts and are still in the process of establishing a stronger trust with their LPs by proving their thesis as well as their investing acuity.

In the spectrum of fund managers starting from First time managers => Emerging managers => Established managers the key element that propels and evolves a manager into the next phase is ‘Trust’.

The journey of establishing the Trust is the one that eventually takes a new manager and evolves him into an established manager (where he/she is in a position to raise larger pools from more sophisticated institutional investors for bigger mandates).

Established Managers vs Emerging Managers

Established funds/managers are typically the ones that have

a) Long operating history

b) Strong Brand &

c) Established track record with multiple funds

They have built deeper relationships & trust with their LPs over a reasonably long time.

However, as we witness more & more cycles it gets clearer from the umpteen instances that these managers/funds face 3 core challenges:

1) Ships that are difficult to steer –

Venture is a crafts business and as the size increases it no longer remains that – The agility and the nimbleness that’s needed to spot and take unconventional bets reduces with large fund sizes.

2) Too big to succeed –

as they are more focused on maintaining their brand and reputation they tend to start making much safer bets (which eventually lead to underperformance) – whereas the nature of venture investing requires one to take a little contrarian approach & take bets that are perceived risky to generate that alpha which hasn’t been spotted by others yet.

3) Misaligned from LPs interest –

These funds have misaligned incentive structures due to a lack of skin in the game & such established managers end up managing disproportionately large pools of capital.

As allocators are witnessing this trend, they have started becoming more open to exploring emerging managers.

The potential rewards of investing in smaller funds run by sharp emerging managers can be significant if done right. If you are an LP looking to generate alpha, then emerging managers should be on your radar.

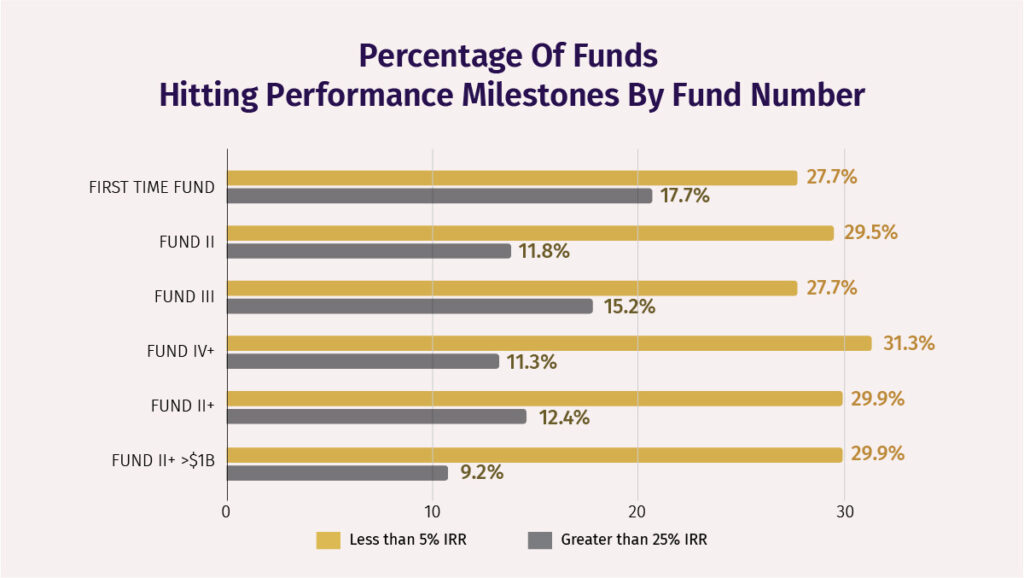

According to a pitchbook report emerging fund managers have a higher chance of 25%+ IRR.

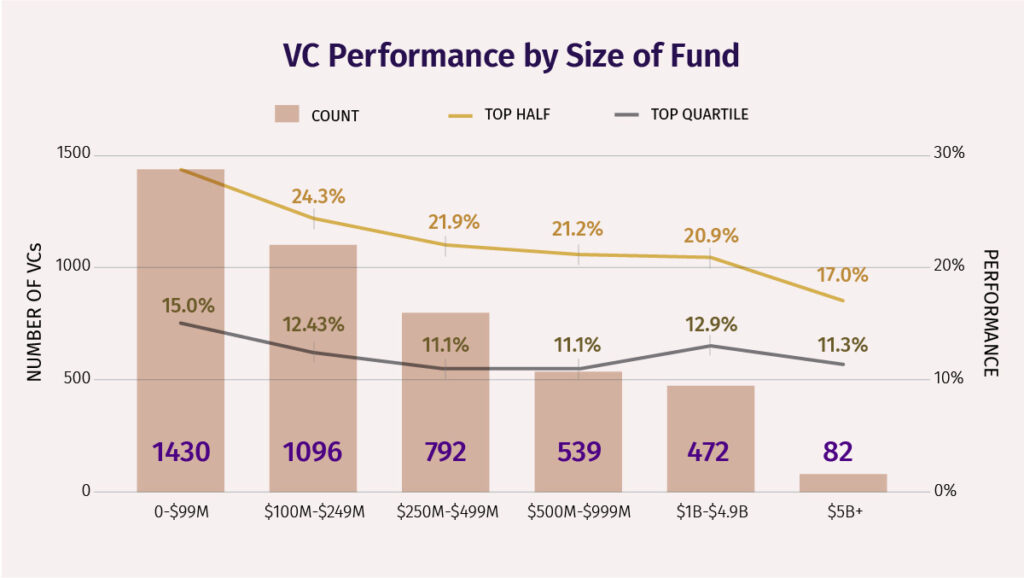

Also, smaller funds – typically run by emerging managers have shown higher returns than large funds.

There are several reasons why LPs are increasingly turning to emerging managers–

- Fresh Perspectives and Agility:

Unlike their established counterparts, emerging managers are unburdened by rigid investment processes and large bureaucratic structures. They have the freedom to be nimble and adapt quickly to market changes, enabling them to capitalise on emerging opportunities that more prominent firms might overlook. Their hunger for success and willingness to take calculated risks can result in outsized returns for LPs. - Untapped Market Opportunities:

Established fund managers often reach a point where they become too large to invest in early-stage or niche markets effectively. On the other hand, emerging managers are often specialists in specific sectors or geographies, allowing them to identify untapped market opportunities with higher growth potential.

- A sharper focus on early-stage companies:

Emerging managers often have a sharper focus on finding and investing in early-stage companies. This is because they are more likely to have the time and resources to do the deep due diligence required to identify and invest in promising startups. - Higher risk appetite:

Emerging managers are often more willing to take risks than their more established counterparts. This is because they have less to lose and are more likely to be rewarded for taking on more risk. As a result, emerging managers are often able to generate higher returns for their LPs. - Innovative approach to investing:

Emerging managers are often more innovative in their approach to investing. They are more likely to use new technologies and methodologies to identify and invest in promising startups. This can give them an edge over their more established counterparts. - Closer relationships with founders:

Emerging managers often have closer relationships with founders than their more established counterparts. This is because they are more likely to be involved in the early stages of the startup process. As a result, emerging managers can often get better deals and more favorable terms for their LPs.

Types of Emerging Managers

Operator turned fund managers –

These are managers with deep domain experience in a particular area. They understand the on-ground realities & nuances of the sector since they have built and operated businesses in those areas and are better positioned to take those bets. They also have some experience with investing either through personal capacity or acting as an SME with a fund. If these managers have the right investment acumen they are positioned to make great investments.

Having operated a business in the same area these managers can connect with founders at a deeper level and hence better placed to win deals with better terms.

Branching off from established funds –

These are typically senior executives/managers at established funds who are venturing out to build their own funds. They already have a well-established network and experience in investing through large funds & managing the portfolio.

These managers are seasoned professionals and have an edge where they have access to great deals due to the right kind of network they typically would have built working at an established fund.

Maturing from smaller funds –

These are the managers who have built and operated smaller funds in the past – they understand the complexity of running a fund as well as typically have refined their thesis and learnt from the mistakes

These managers ideally come with strong investment acumen and the ability to identify & deploy in the right companies to generate alpha.

New managers –

These managers primarily have some personal or professional track record on the basis of which they have ventured out to build a new fund. They usually have an edge in a particular niche/sector. They typically start with a smaller fund or a syndicate and work their way up by building trust through their performance.

Identifying the right ‘emerging fund managers’

| Characteristics | Description |

|---|---|

| Have experienced failures | They usually have made mistakes and failed on certain investments however have the humility to accept and learn from it |

| Independent Thinkers | They are usually first principles thinkers and not affected by the transient narratives and market cycles |

| Proprietary insights | They typically have a couple of multi-bagger wins in their kitty |

| Unique access | They have unique access to deals in their area of focus |

| Quality of the network | They have a differentiated network that can be leveraged to execute the mandate |

| Have seen market cycles | They understand and have witnessed market cycles and are sharp enough to take advantage of it |

| Past Wins | They typically have a couple of multibagger wins in their kitty |

| Made Distributions | They have distributed capital when they get an opportunity |

| Focus on good governance | They ideally have a very high bar on governance |

| Handled complexities | They have handled complex regulatory frameworks and been compliant |

As the venture capital landscape evolves, LPs must stay adaptive and open to exploring opportunities beyond traditional investment paths. Emerging fund managers bring a fresh approach to the table, with their agility, specialised focus, and strong alignment of interests with investors.

In a world where established managers with large funds have not been able to outperform despite the brand, identifying the right emerging managers can pave the way for sustainable alpha for the LPs and fund allocators.